Purse strings set to loosen in 2011

Ralf Matthaes, Taylor Nelson Sofres regional managing director for Vietnam and Malaysia, provides a unique insight into Vietnamese consumer spending trends in 2011.

|

| More and more Vietnamese are enjoying that spending feeling |

In order to better understand spending trends in Vietnam, the population as a whole cannot be lumped together. Instead, it must be segmented into three categories, rich vs. poor, urban vs. rural and young vs. mature. This will truly show that Vietnam has come a long way in the past 15 years in terms of new segments and their differentiating needs and desires.

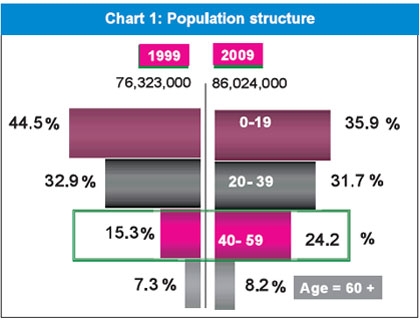

Due to the positive impact of Vietnam’s family planning programme, as well as raising awareness of the population’s responsibility towards children, Vietnam’s population only grew by 10 million from 1999 to 2009. Notably, those aged 40-59 (considered as matured consumers) have become a relatively important proportion, comprising over 24 per cent.

|

|

Vietnam’s population is becoming more mature and the fast development of the retail market in an open economic environment has sped up the maturation and sophistication of this consumer segment.

However, Vietnam’s population is still very young. According to the recent population census, some 30 million Vietnamese are aged 19 and below comprising 35 per cent of the population.

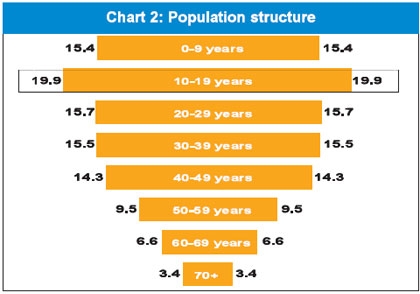

As can be seen in charts 3 and 4, 19.9 per cent of the population today is aged 10-19, meaning that over the next 10 years a staggering 17 million young Vietnamese will be entering the consumer market. These Vietnamese kids are growing up with MTV, internet and much higher expectations and are slowly beginning to adopt a different value system from previous generations. These young and switched on consumers will have very different tastes, needs and desires, which opens up a brand new opportunity for marketers and retailers throughout Vietnam.

|

|

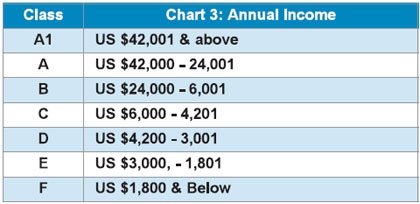

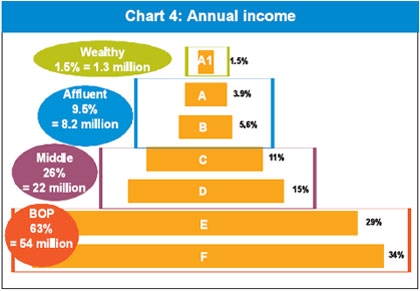

Rich vs. poor

As modeled in the income pyramid (Chart 3), two-thirds of Vietnam’s population is comprised of low income groups (less than $3,000 per year) and these households are still grappling with the basic needs of consumerism. Moreover, the impact of inflation (11.7 per cent) in 2010 and the devaluation of the dong will continue to eat into the purchasing power of these consumers. However, these consumers are also being influenced by mass media and the growth of wealth and also wish to gain consumer inclusion. Hence, affording inspirational products and services for this huge segment of Vietnam is truly a mega opportunity and will be a consumer trend for years to come.

Roughly 1.5 per cent of Vietnam’s population, equivalent to 1.3 million, can afford to live the high life. According to our survey, the members of this group often use high class services, luxury goods and of course travel overseas. They are as affluent as in the western world.

Urban vs. rural

The income levels vary widely between rural and urban Vietnam. In total, 1.3 million rich people, 77 per cent (equivalent to about one million people) are living in the big cities (Hanoi, Ho Chi Minh City, Haiphong, Danang and Can Tho). Inversely, about 7.2 million poor live in urban areas, while nearly 47 million exist in rural settings. Thus, for every 100 rural consumers, 80 belong to low-income groups. This is noteworthy for manufacturers to make goods for distribution in rural areas.

No comments:

Post a Comment